Insights and Strategies

Hawks Pounce as Doves Cry

Investors entered 2023 hopeful and, in some cases, even convinced that the fight against inflation was largely a 2022 story with both the U.S. Federal Reserve (Fed) and the Bank of Canada (BoC) set to end their tightening efforts with an eventual pivot towards rate cuts in H2/2023 if not sooner. However, to investors’ surprise, the hawkish narrative has resumed, following stronger-than-expected economic releases on both sides of the border for employment, inflation, consumer spending, etc. This, in the aggregate, suggests that the inflation fight which began in 2021 is far from over and will likely continue to remain a central theme for markets and investors in 2023.

However, while we believe the peak is in for inflation, the path forward will be anything but a straight line down back towards the historical trend. This is why we have maintained our call that a mild recession in Canada and the U.S. is likely to occur in 2023/2024 versus a no-landing scenario, which, not surprisingly, has made headlines recently.

In our view, the lag effect of the aggressive policy changes in 2022, in particular the ~400-450 bps-increase in overnight rates – coupled with the imprecise impacts of these policy changes on the various components within the consumer price index (CPI) bucket and the broader economy – makes predicting the end of the fight very challenging and a game we choose to avoid playing. Rather and more importantly, for investors, we believe these factors, at the very least, suggest to us that central banks will likely need to maintain higher rates for longer than most had expected versus the dovish outlook of cuts that many had hoped and wished for as we entered 2023.

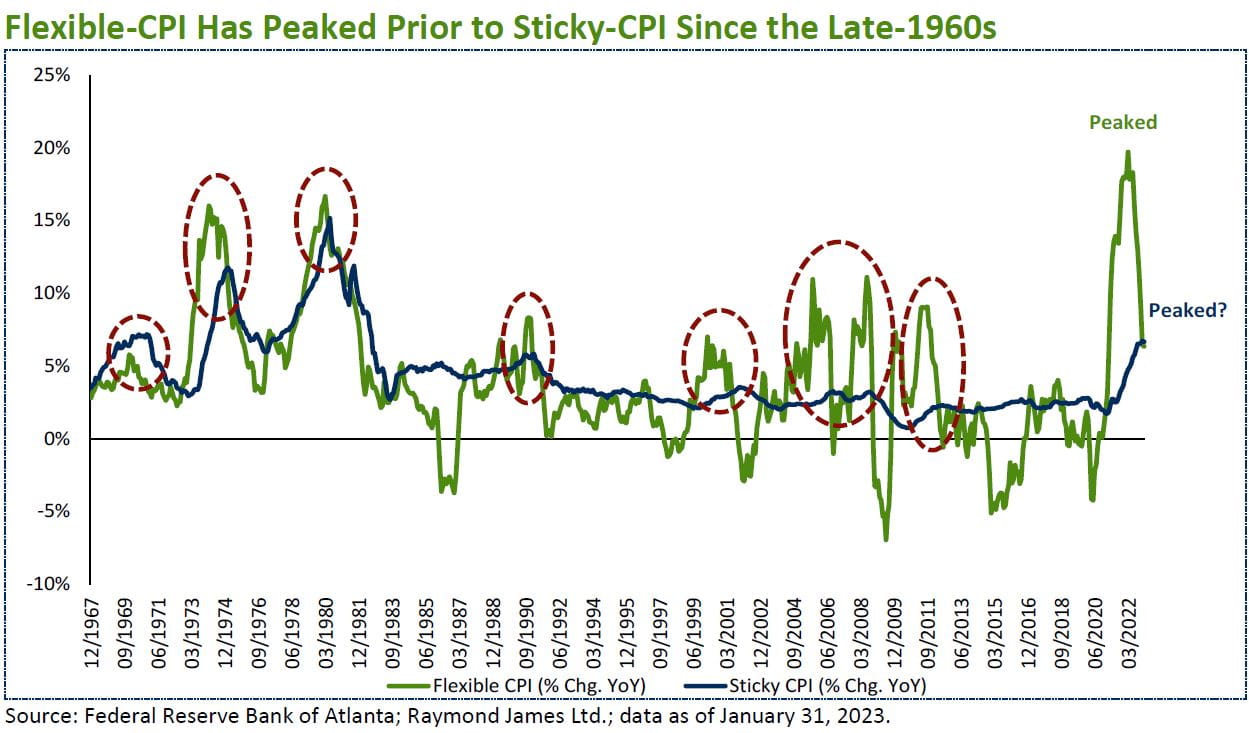

For example, within the U.S CPI basket, sticky-price items (e.g., food away from home, rent, and recreation) represent ~70 per cent of the overall basket. These items do not respond quickly to changing market conditions compared to more “flexible-price” goods (e.g., new/used vehicles, gas and electricity, lodging away from home) that represent the remainder of the CPI basket. As we demonstrate in the chart below, U.S. flexible-CPI has typically reached a peak prior to sticky-CPI since the 1960s. Rate increases and fiscal tightening impact these CPI basket components much sooner than they do for sticky-priced goods.